Workbar Isn’t Just About Desks: Making Work Work, CEO Series Vol. 2

We say this all the time: Workbar is more than just desks and WiFi....

We have a lot of ideas around here. We can’t say our blog has a theme other than what we’re thinking about this week, but we swear it’s all worth the read.

From coworking trends to productivity hacks, member spotlights, and more, we’re here to spark all the inspiration and ideas.

We say this all the time: Workbar is more than just desks and WiFi....

Looking for a way to stay productive this summer while your kids are...

Buying local is not just a feel-good slogan; it’s a powerful economic...

Bostonians are early adapters, so it’s not surprising that Boston is...

Thinking about coworking in Boston but not sure where to start? This...

When I became CEO of Workbar in May 2018, the company was operating...

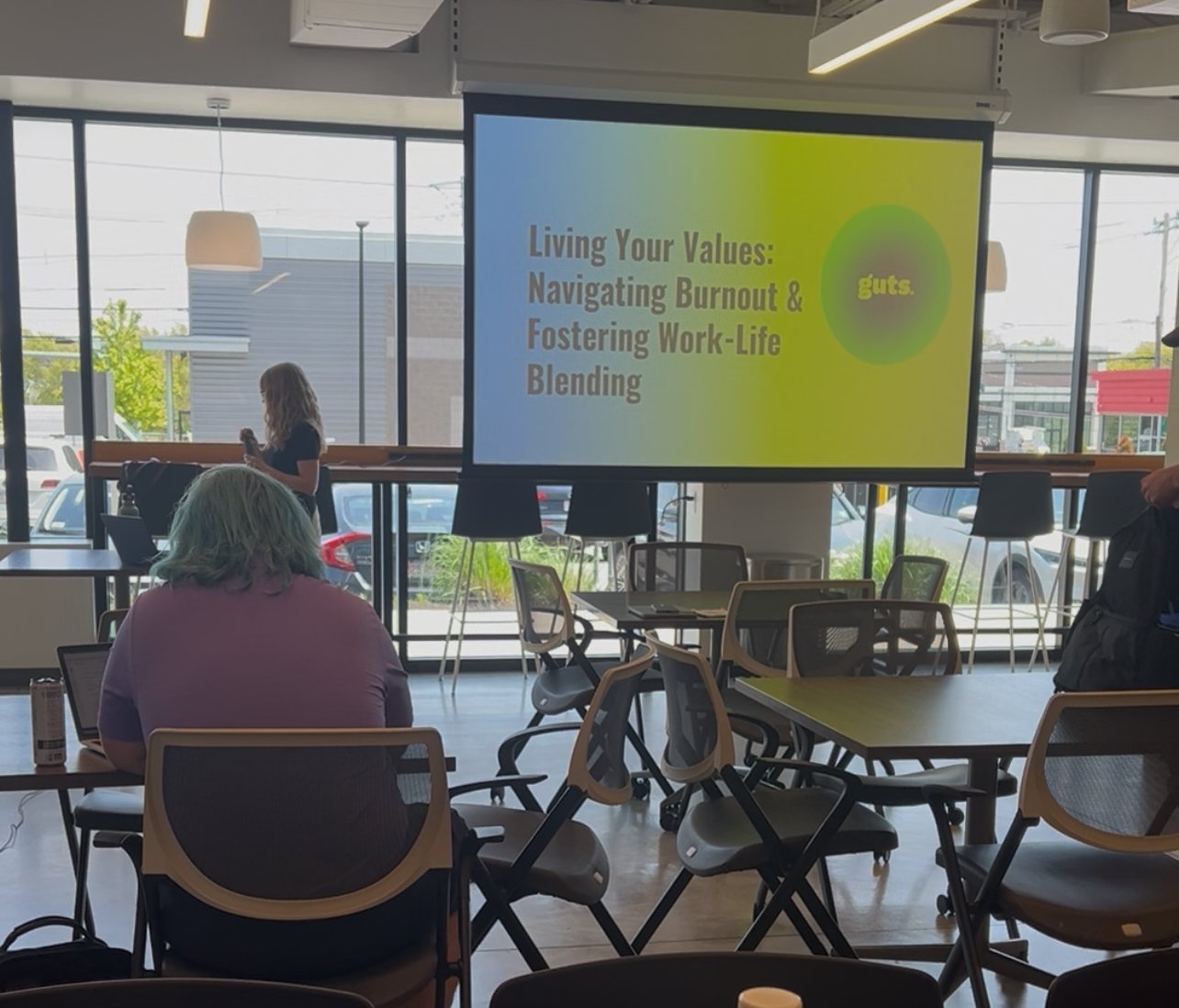

We met Dr. Jenn Staples at Work the Room in our Arlington location,...

Toxic workplace culture is easy to spot. It’s the all-hands meeting...

Working from home ain’t what is used to be, people. What used to feel...

Our coffee? Iced from Dunks, year-round. Our river? The Charles, it’s...

We’ve all been there — you wake up in the morning feeling unmotivated...

Boston office buildings have taken a massive hit. According to a...

“Wow, your business must do well during times of economic...

Fortune 500 giants and Boston’s next unicorns aren’t just choosing...

When we opened Workbar Cambridge in 2013, we had a member you might...

In 2021, I wrote about how hybrid work could be a game changer for...