The Future of Money with Bitcoin and Blockchain

Inside the DCU FinTech Innovation Center (a Workbar partner location and financial technology incubator) the emerging technologies of bitcoin and blockchain have already emerged. Havell Rodrigues, CEO/Founder of one of the Center's Member Companies, Adjoint, and Jason Morton, the Center's Entrepreneur in Residence, are experts in blockchain and discussed how this technology is shaping the future of money.

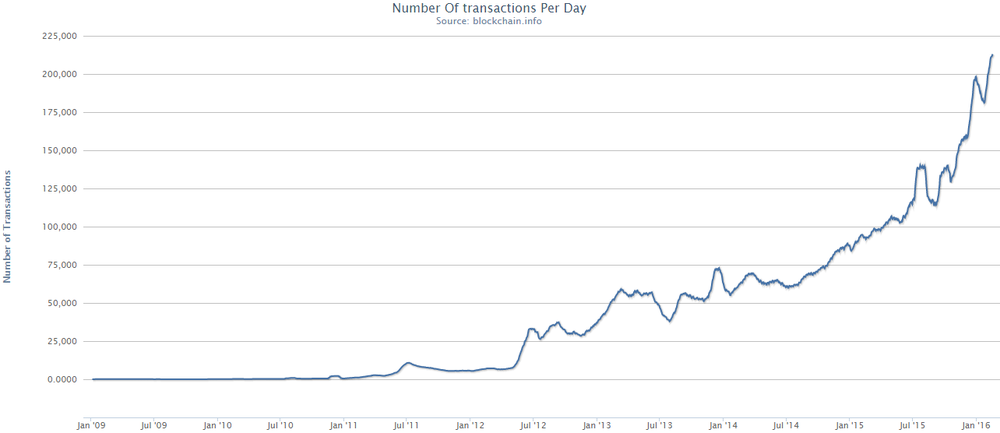

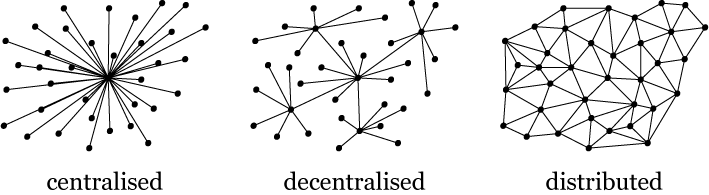

"Blockchain is the future of the internet, or what the internet-of-value could be." When Rodrigues describes blockchain's potential he warns me that it gets pretty technical pretty fast. One of its more well-known applications of it is bitcoin, a digital cryptocurrency. No one controls it, no one prints it out, and there will only ever be 21 million of them in "circulation." Doubtful as it may seem, bitcoin does have the properties of currency: scarcity, fungibility, divisibility, durability, transferability. From its humble beginnings in cryptography circles circa 2008, bitcoin's popularity exploded along with the need for anonymous e-commerce transactions on Dark Web sites like the Silk Road; now giants like Overstock.com and Microsoft accept them. But the real magic of bitcoins is made possible by the "Distributed Ledger Technology" behind blockchain, a kind of "incorruptible" digital ledger that lives like an irrefutable electron – everywhere and nowhere at once.

As Rodrigues puts it, "This is the next level of value creation and exchange."

So why is it called blockchain? "Well, 'Block', is used because transactions are reported in blocks in a database, which provides immutability through the concept of 'chain', the concept of 'hashing'. Essentially the system creates a hash of the underlying database, a new block is added to the database, and then blocks are chained together where all participants have guarnatee of immutability of data. No one can go back in time and change previously recorded data. You change the data, you change the hash- it won’t match hash that everyone else has." Because this system is open-source and updated constantly, it's too ubiquitous and too fast to hack.

It's also catching on. "Financial institutions have taken a big step forward, doing proof of concepts and experimenting with private blockchains to see what it can do. They have seen the business value of this technology, especially in its role of reconciliation of financial transactions, and are going into production mode," including the DTCC. "I've got a bullish optimism with blockchain, or what I prefer to call Distributed Ledger Technology," he says, before walking through a range of applications that eventually veer towards sustainability and the sharing economy.

"Blockchain removes inefficiencies, enables new business models, and drives down costs from the system of investing. There's less paper trail, but a clear audited digital trail. Put entire communication trails onto blockchain, with smart contracts automating work flows, and make this info accessible only to relevant counterparties or to regulators."

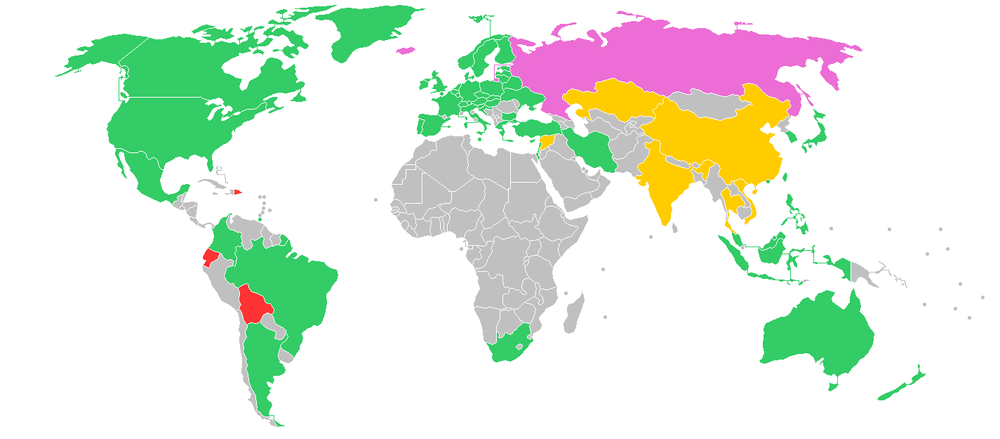

Jason Morton is taking time off from being a math and statistics professor at Penn State to focus on his startup, and he waxes pragmatic and political when discussing blockchain. "One of the most interesting things to watch now is how [blockchain] interacts with the regulatory and geopolitical environment. By now it is clear that political instability - be it India's currency recall or Trump's rapid actions on trade and international relations - benefits blockchain technologies due to their role as a hedge and their permissionless nature."

While lack of regulation leads to heightened risk and uncertainty, Morton maintains that restrictive regulation keeps too much money on the sidelines, choking business models before they can develop. Because the new administration is in the midst of a rollback of Dodd-Frank and other components of regulatory frameworks, "This seems like an odd time to aggressively regulate public blockchain initiatives, so it is likely we can expect a period of lassiez-faire for blockchain while the focus is elsewhere."

While this bodes well for blockchain's future and acceptance, Morton warns that "the relatively high level of regulation we have experienced was likely a two-edged sword for blockchain technologies." On the one hand, it has increased demand for tokens (such as bitcoins) but it has also kept a lot of people from wanting to get involved in public blockchain projects due to concerns over regulatory risk. "So a reduction in regulation could go either way. The need for token-based crowdfunding may be reduced... or, blockchain-based mechanisms could have the freedom to become the dominant platform."

With the FinTech sector enthusiastically exploring its applications, blockchain is primed for "disruptive" innovation. As Rodrigues puts it layman's terms, "The system is safer and better than emails and faxes, which are sadly still used today. You could have Uber or Airbnb decentralized; you could have peer to peer real sharing economies using this underlying technology."

Mass collaboration and advances in coding are replacing intermediaries like governments and banks, and the revolutionary shift triggered by blockchain will be a crucial component of the Internet's Next Big Thing. And if you stand in the right place, you can already see it coming.

About Workbar:

Workbar operates coworking locations throughout greater Boston (Boston Back Bay, Boston South Station, Burlington, Cambridge, Arlington, Brighton, Danvers, Norwood, Salem) and several other partner locations throughout the state. Want to keep up with the world of Workbar? Subscribe to our mailing list for the most up-to-date information about our upcoming events and community news. You can also follow us on Instagram, Facebook, LinkedIn and Twitter.